A word about budgets

Overview

Although Thrive in Life Kit includes tools to manage, visualize, summarize, and gain insight into your finances, it does not include a section to create and manage a budget.

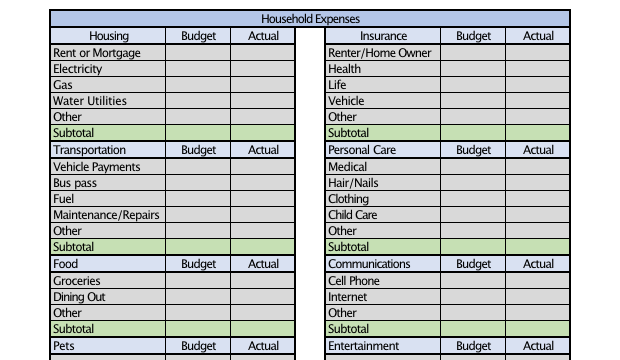

Budgets

Budgets are a static set of financial targets by category over a time period (e.g., monthly). So, how are those targets determined?

What is the real goal?

If we make a really big goal and we don’t stick to it, we start to lose trust in ourselves. We start to think that maybe we are the problem: that we must lack motivation or discipline. But what if the issue isn’t us, but the method. Real progress comes from small daily commitments – the micro habits. Just tiny everyday actions that, over time, compound into significant positive change.

The real goal, then, is to develop small habits to minimize expenses continually and maximize incomes rather than trying to satisfy some big monthly financial targets. This new approach opens up financial goals to be more effective and encourages better personal financial habits for growth. And, that is what this is about – your financial habits. As such, Thrive in Life Kit app focuses on tracking, observing and gaining insight from your financials.

There are links to two non-budget videos that are surprisingly well-done. Both of them focus on goals, habits, and guardrails without trying to optimize budgets to an extreme level of detail.

More information

YouTube video: I Stopped Budgeting After Learning This | Financial Minimalism by Gabe Bult

YouTube video: If you hate budgeting, try this instead by Money with Lilly